The NSW Government released the 2020-21 State Budget this week. The Government forecasts a deficit of $16 billion in 2020-21 and a return to surplus in 2024-25.

The most topical items addressed in the budget are these:

Payroll Tax Cuts

In May 2020, the NSW Government brought forward by one year the increase in payroll tax threshold to $1 million.

This Budget announces a further permanent increase in the payroll tax-free threshold from $1 million to $1.2 million.

The NSW Government will also cut the payroll tax rate from 5.45 per cent to 4.85 per cent from 1 July 2020 for two years.

Digital Vouchers

This budget commits $472 million to provide small and medium-size businesses, which do not pay payroll tax, with a $1,500 digital voucher for the cost of government fees and charges.

Stamp Duty and Land Tax Reform Proposal

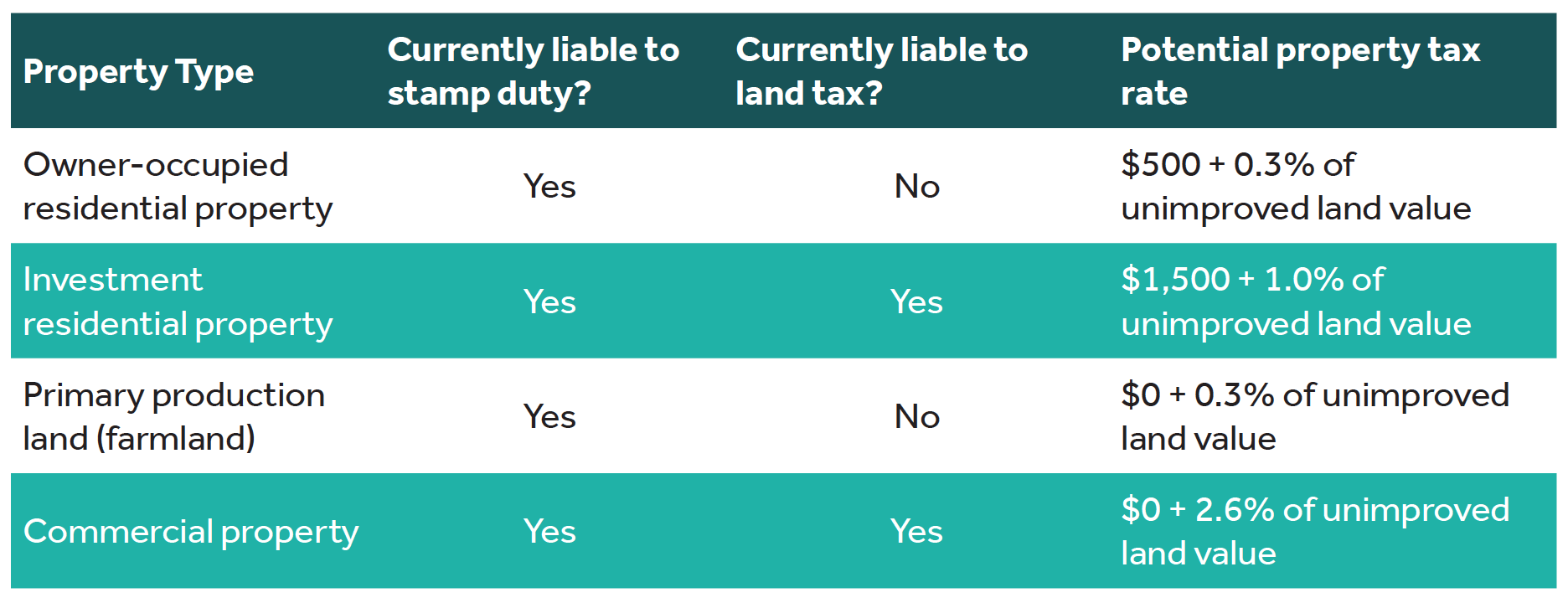

The NSW Government released a Consultation Paper on replacing stamp duty and land tax with a single property tax on an ‘opt-in’ basis for future purchases.

The Government outlines an indicative way the scheme could work:

Total NSW Revenue

The total budgeted Revenue for NSW in 2020-21 is $82.1b. Commonwealth Grants (GST) makes up $33b and State Taxes $32b. The main state taxes are Stamp Duties ($10b), Payroll Tax ($8.5b), Land Tax ($4.6b) Motor vehicle taxes ($2.4b) and Gambling and Hotel Gaming taxes ($2.8b).

For more on the 2020-21 NSW Budget please click here.

If you have any questions about how the NSW Budget may affect you or your business please contact your Nexia Advisor.